Hello, in this post we will learn Default ledger creation in Saral software. Follow the step by step procedure.

Default Ledgers are the common ledgers across any business type i.e., Tax ledgers and others ledgers like Cash a/c, Bank a/c, Discount, Round off etc.

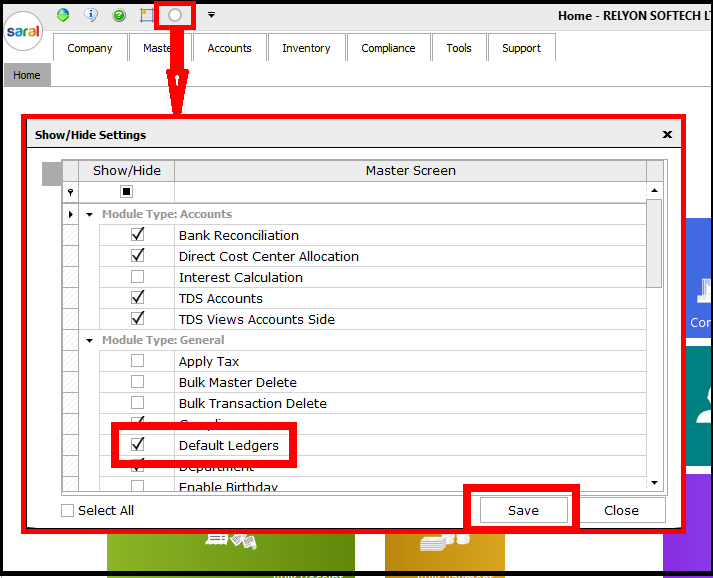

IN Saral, on creating the new company and entering the master details, through the settings wizard you can create the default ledger or else create at a later time. To create the default ledgers later, firstly display the Default option in the Menu bar by enabling it under Show/Hide options window.

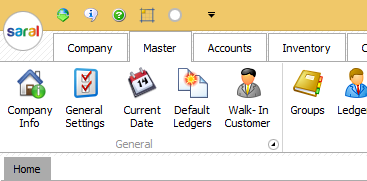

On saving the settings, Default Ledger option will be displayed under Master Menu.

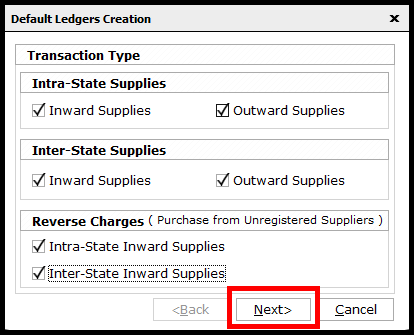

Click on Default Ledger option and enable the different types of transactions carried out by you. I.e. Inter & Intra-state Sales & Purchase transactions as applicable.

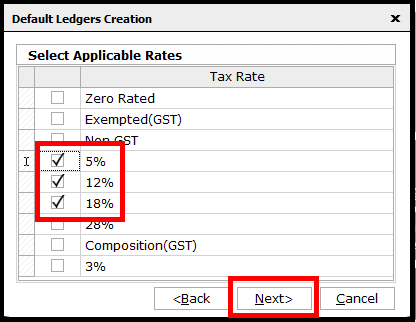

Click Next and select the Rate of Tax applicable for the selected Transaction types.

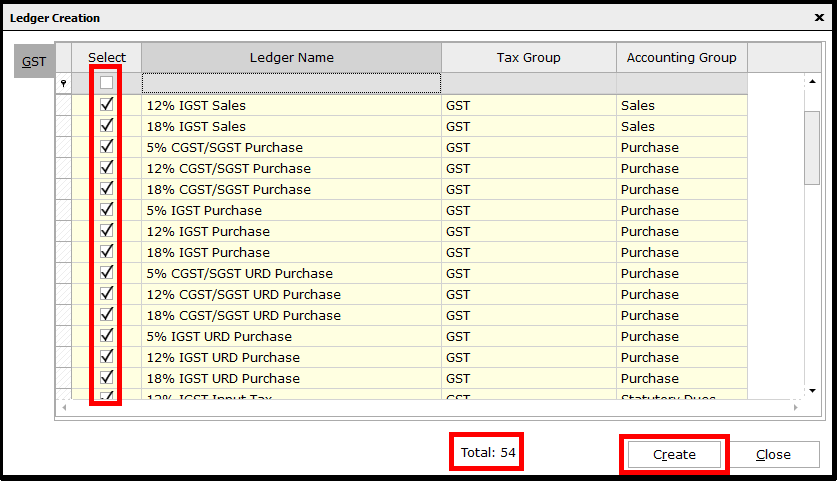

On the Next click, you will be displayed with the list of ledgers for the type of transactions Tax rates selected. Check Select box to select the ledgers to be created. The total number of ledgers will be listed below.

Now, click on Create to create the ledger. The ledgers so created can be viewed in Ledger option under the Master menu.

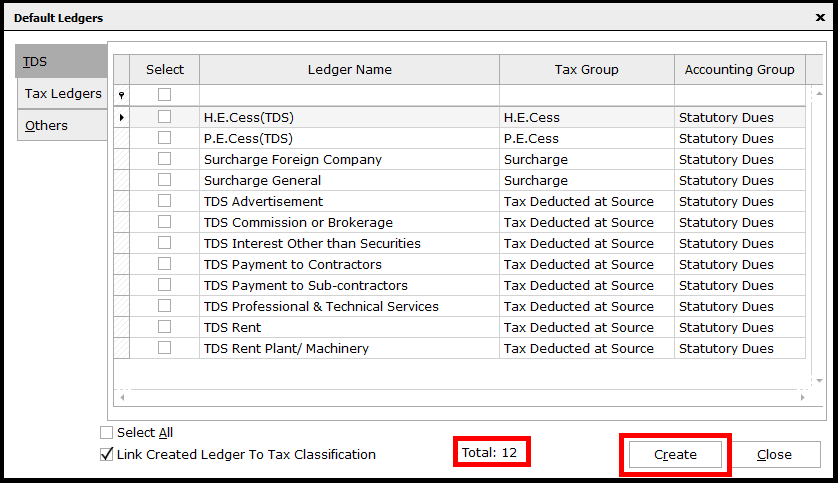

Along with GST ledger, the user can also create default ledger related to TDS on enabling TDS in Accounts module. The list of ledgers will be as shown in below screenshot.

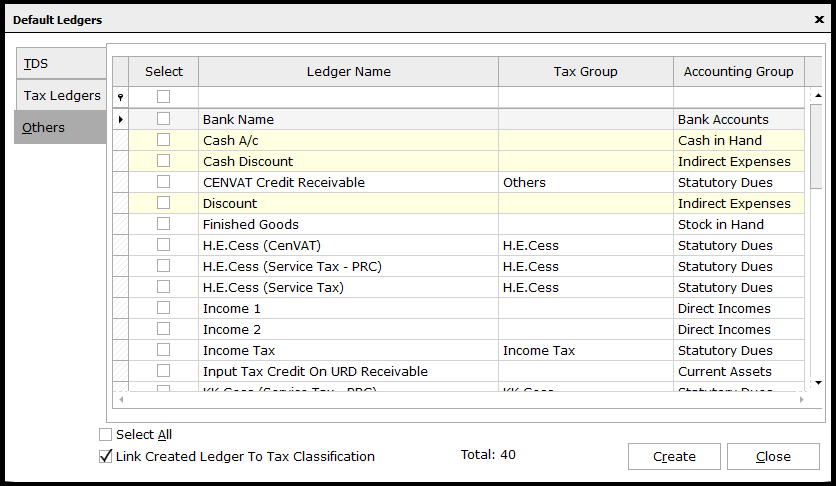

And other ledgers

Note: The ledger name can be changed before creating the ledger. Also, these ledgers can be created only once.

Related: