In this post, we will view GST Computation details before GST return filing and also the process of auto porting tax payable/refundable details to journal voucher from the computation screen.

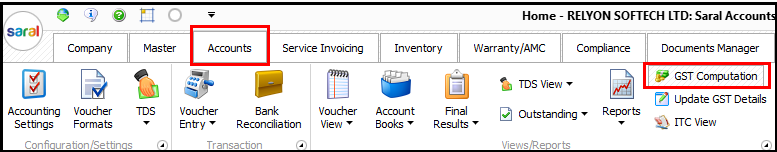

To begin with, go to GST Computation under the Accounts module.

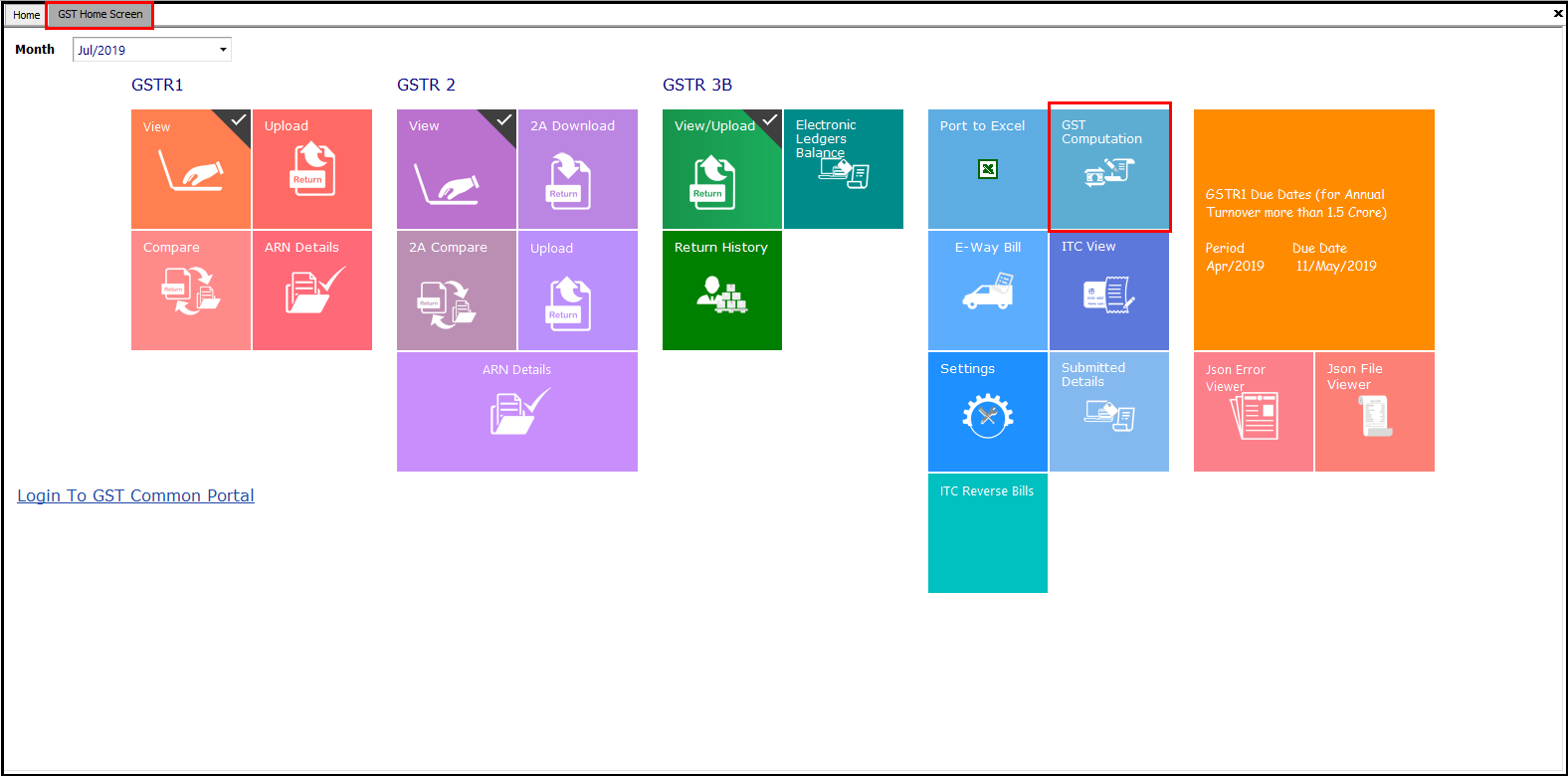

You can also visit the screen under GST Returns home screen.,

You can also visit the screen under GST Returns home screen.,

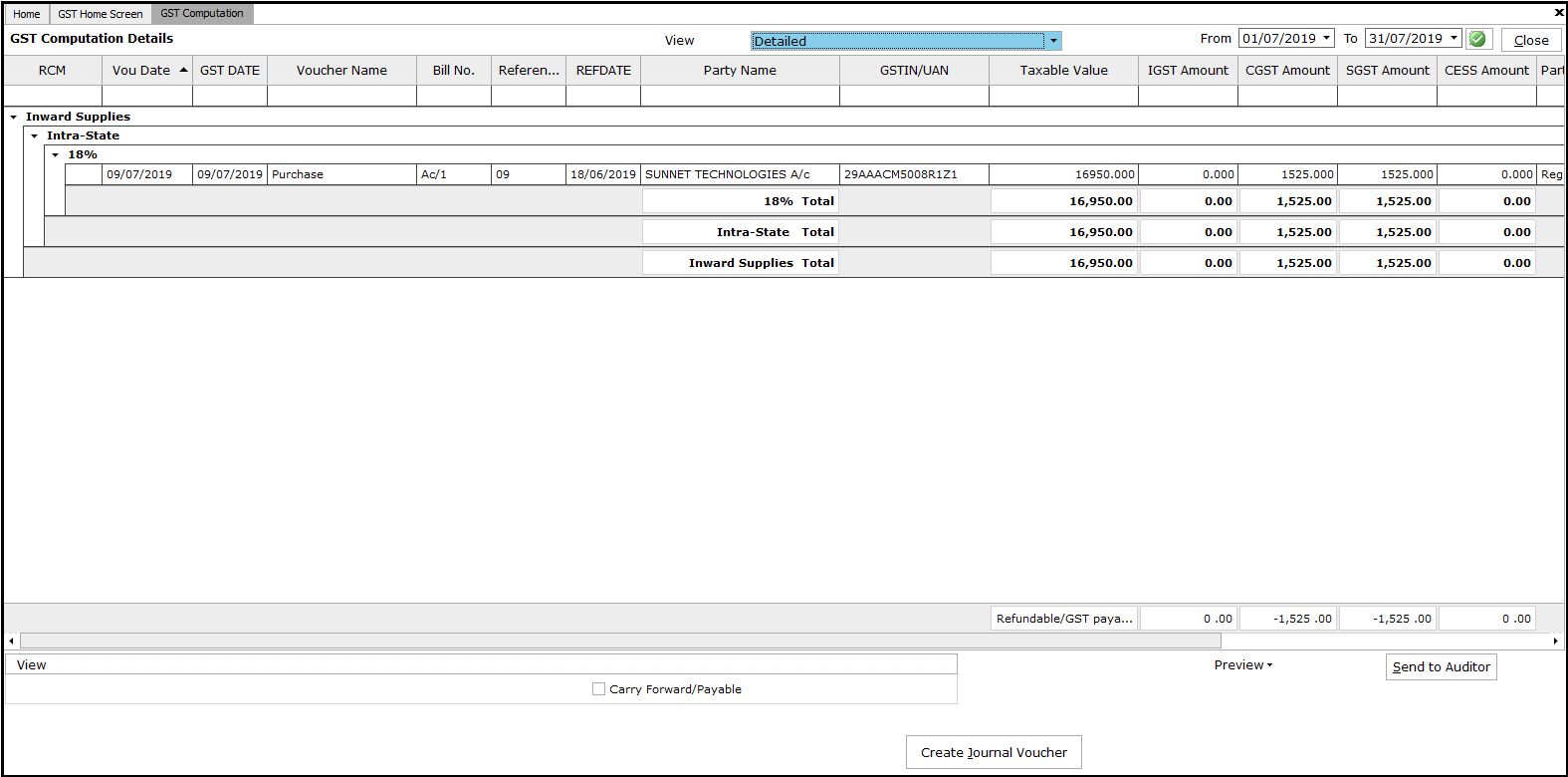

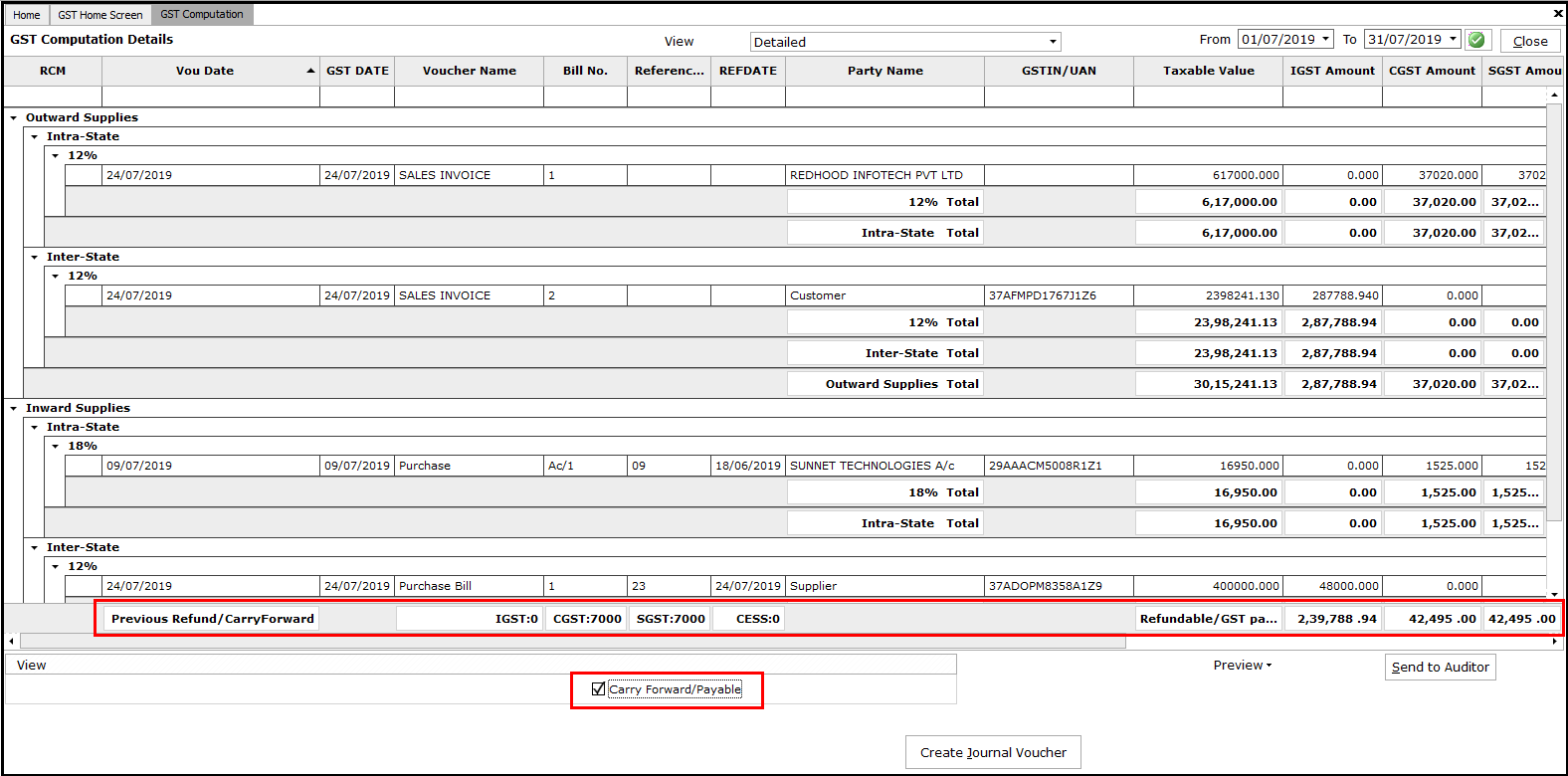

On selecting the period for which the computation is to be viewed, the computation screen will be displayed.

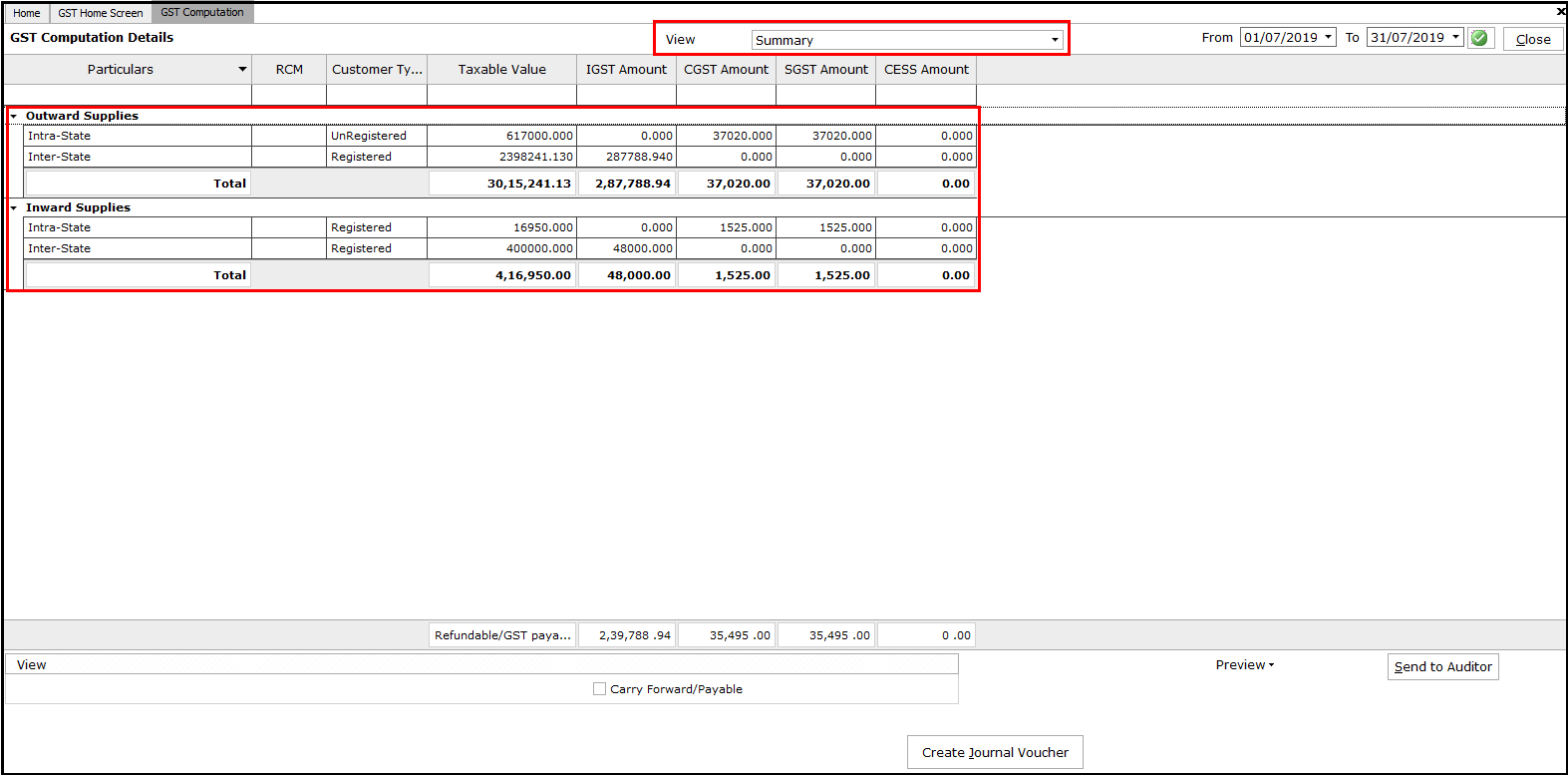

The details can be viewed at a different level based on the requirement. The different views are as below;

The details can be viewed at a different level based on the requirement. The different views are as below;

- Summary: Consolidated information of sales and purchase transaction classified as Intra/Inter and as Registered/Unregistered/Composition dealers

-

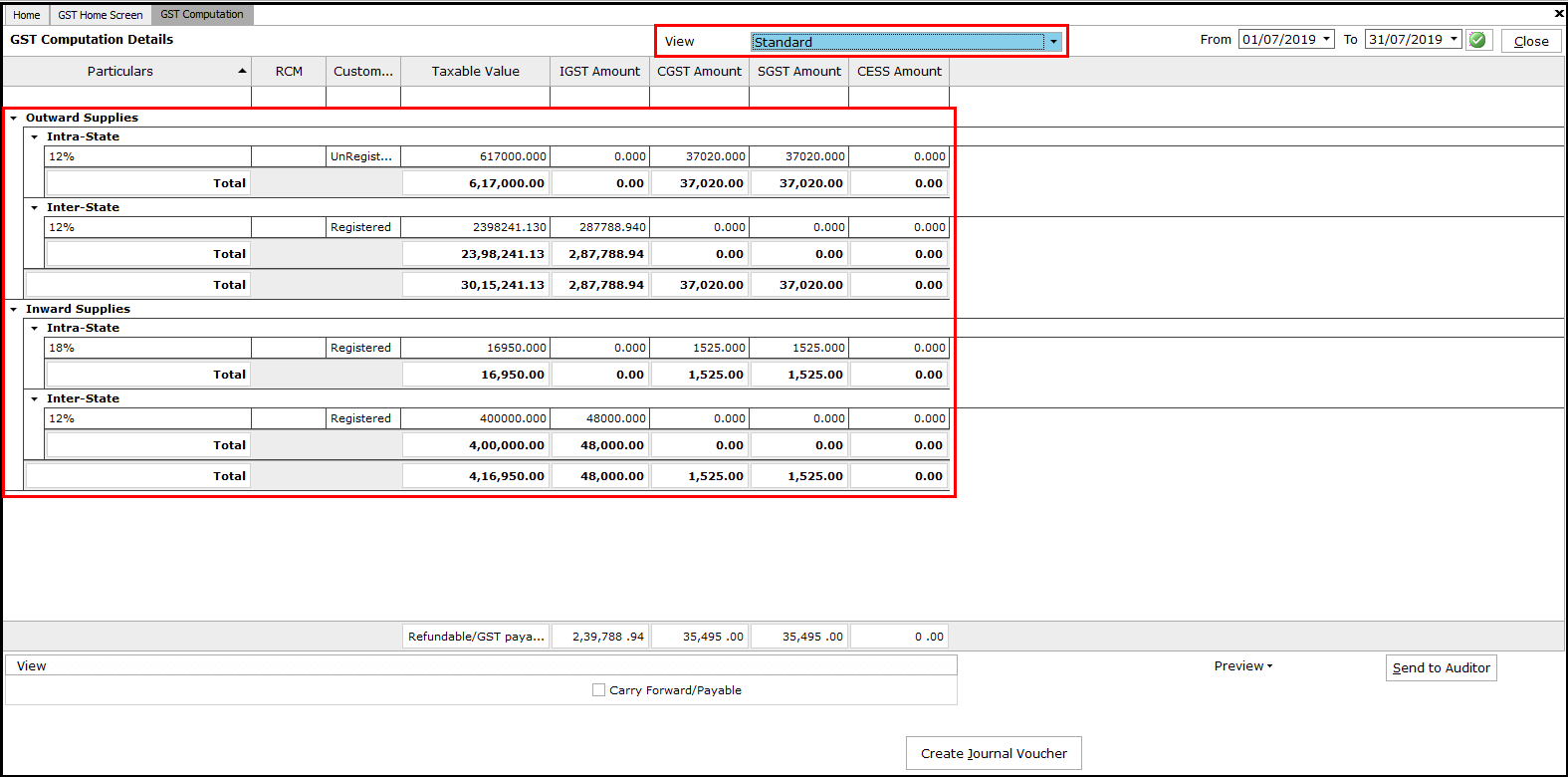

Standard: Information of sales and purchase transactions classified as Intra/Inter, Registered/Unregistered/Composition dealers and sub-classified under the respective tax rates

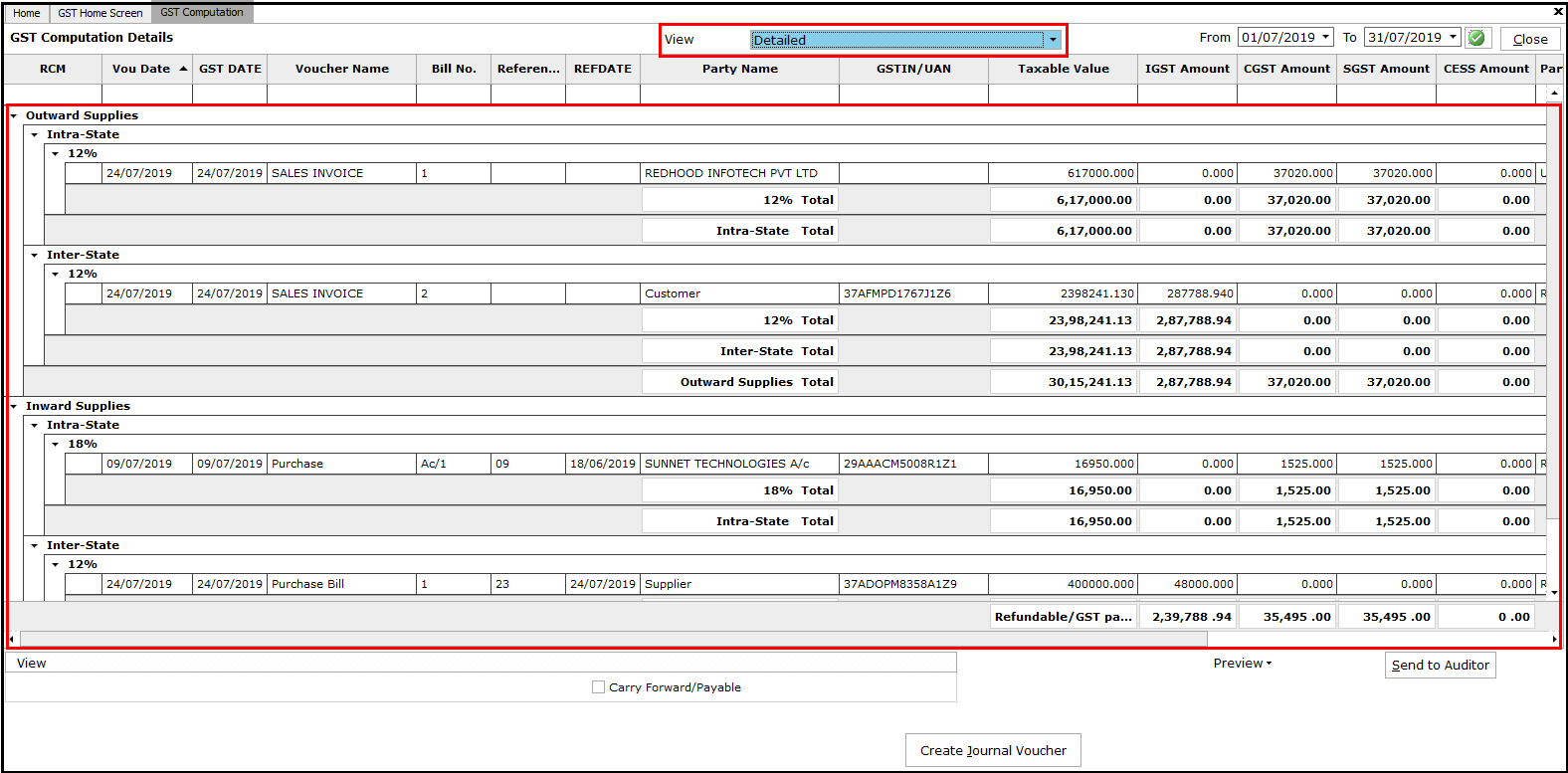

- Detailed: Information on sales and purchase transactions classified as Intra/Inter, Registered/Unregistered/Composition dealers and sub-classified under the respective tax rates. In this view, individual invoice details can be viewed in detail.

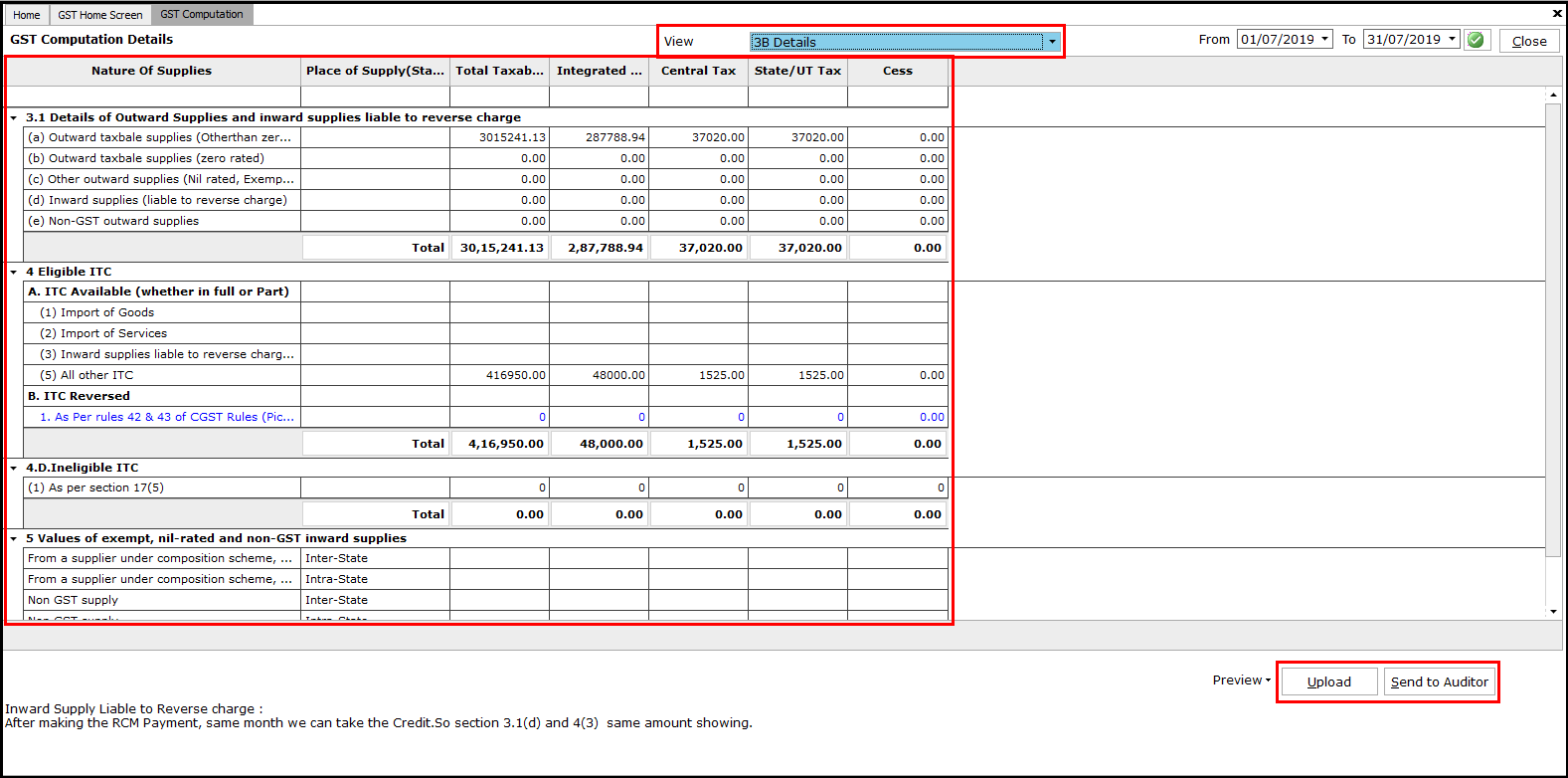

- 3B Details: On selecting this view, the data required for filing GSRT 3B will be displayed in the applicable format.

Note: On the click of Upload, the details will be auto taken for the GSTR 3b upload screen from where the JSON file can be created and uploaded. On click of Send to Auditor, the details will be taken in an excel file and mailed to the auditor, provided Email Settings are completed.

Note: On the click of Upload, the details will be auto taken for the GSTR 3b upload screen from where the JSON file can be created and uploaded. On click of Send to Auditor, the details will be taken in an excel file and mailed to the auditor, provided Email Settings are completed.

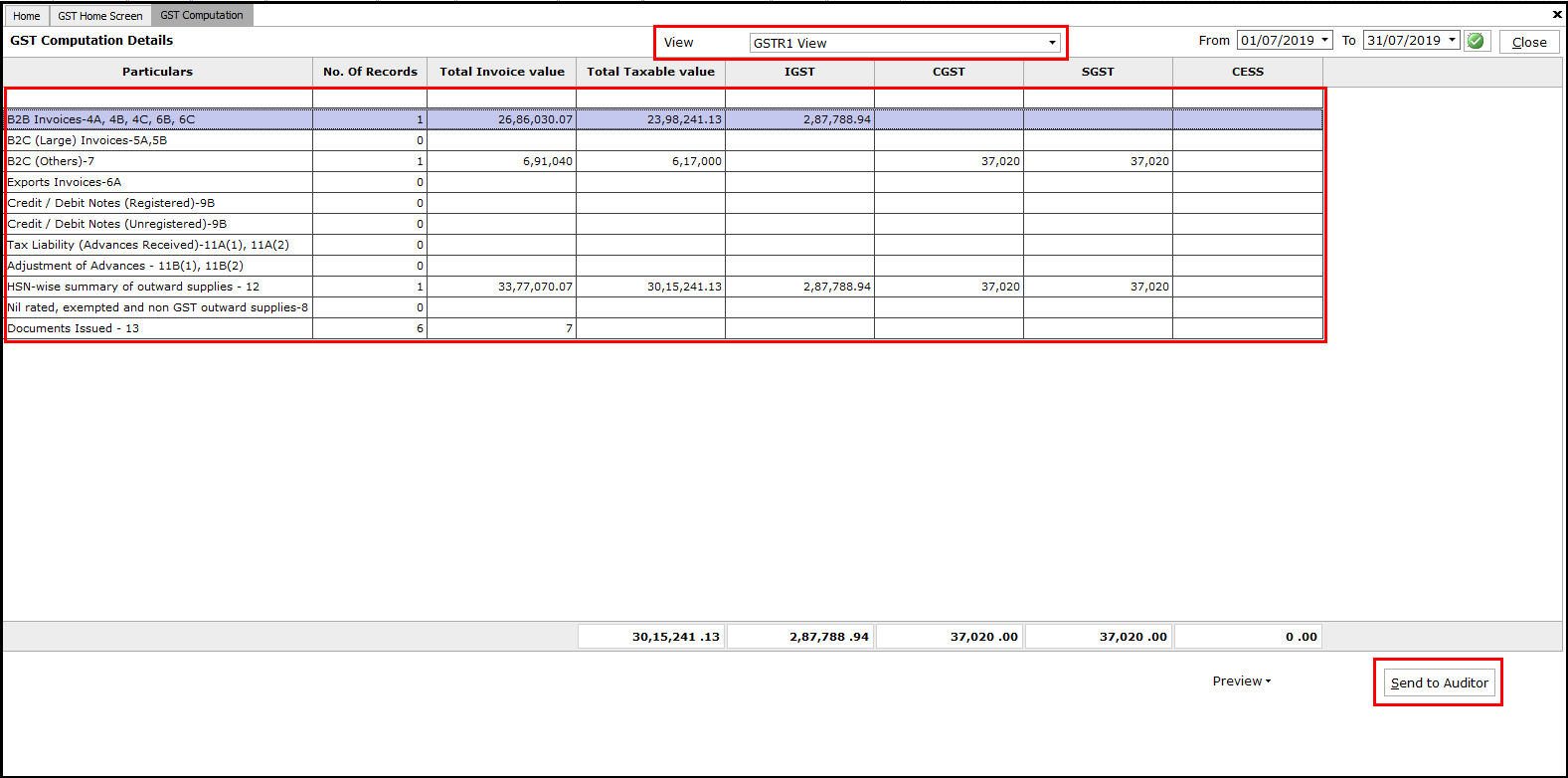

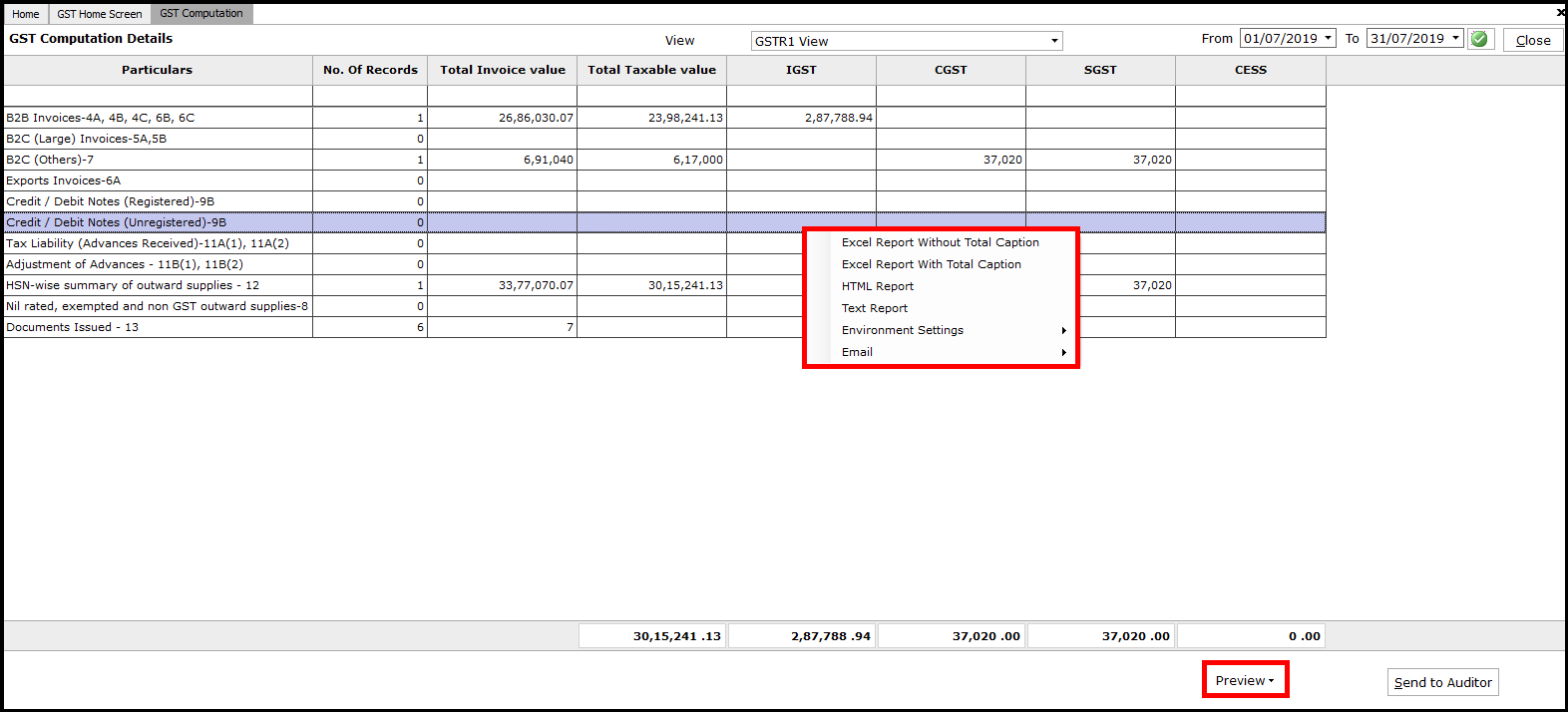

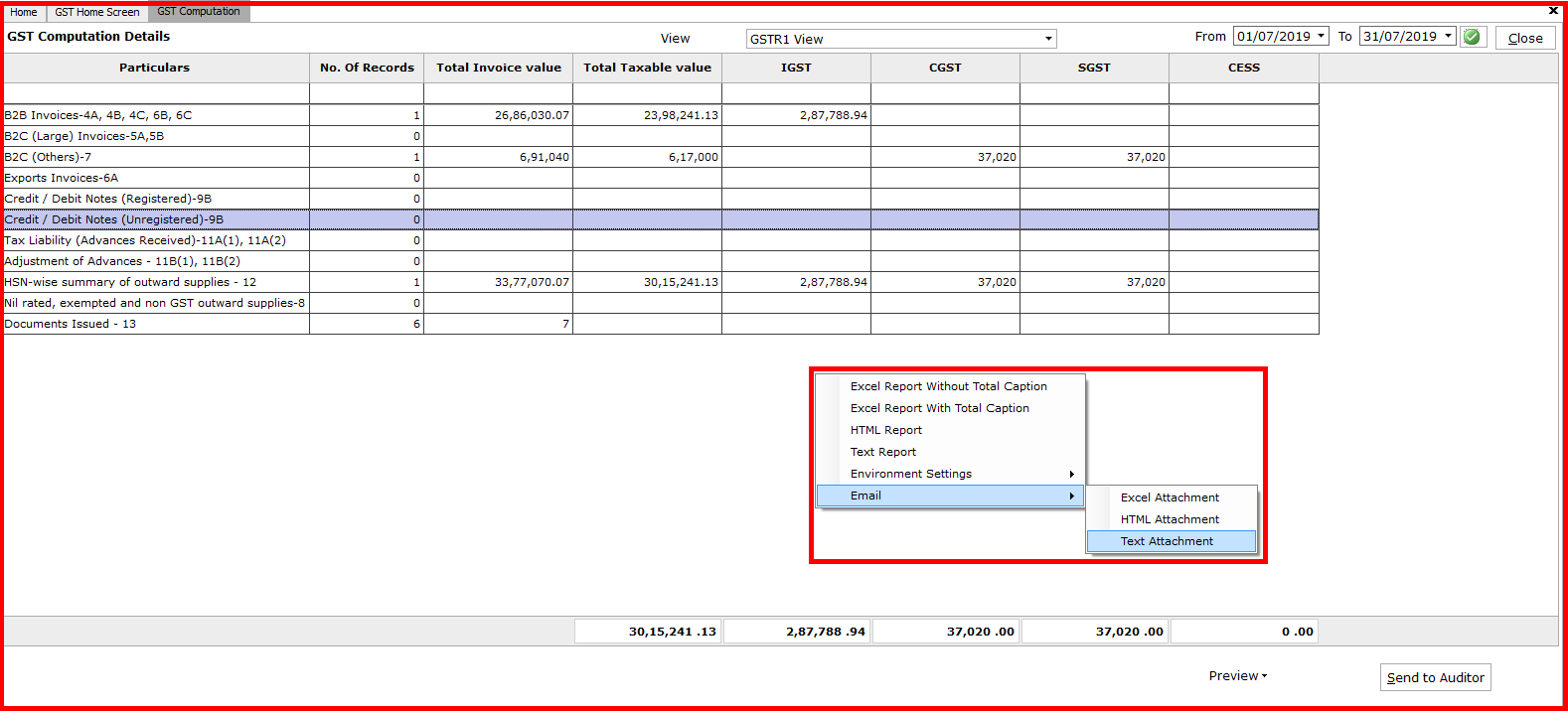

- GSTR1 View: In this view, the details required for GSTR1 filing can be viewed in their respective categories.

Note: Double click on any category to view the detailed information on invoices taken for computation. On click of Send to Auditor, the details will be taken in an excel file and mailed to the auditor, provided Email Settings are completed.

Note: Double click on any category to view the detailed information on invoices taken for computation. On click of Send to Auditor, the details will be taken in an excel file and mailed to the auditor, provided Email Settings are completed.

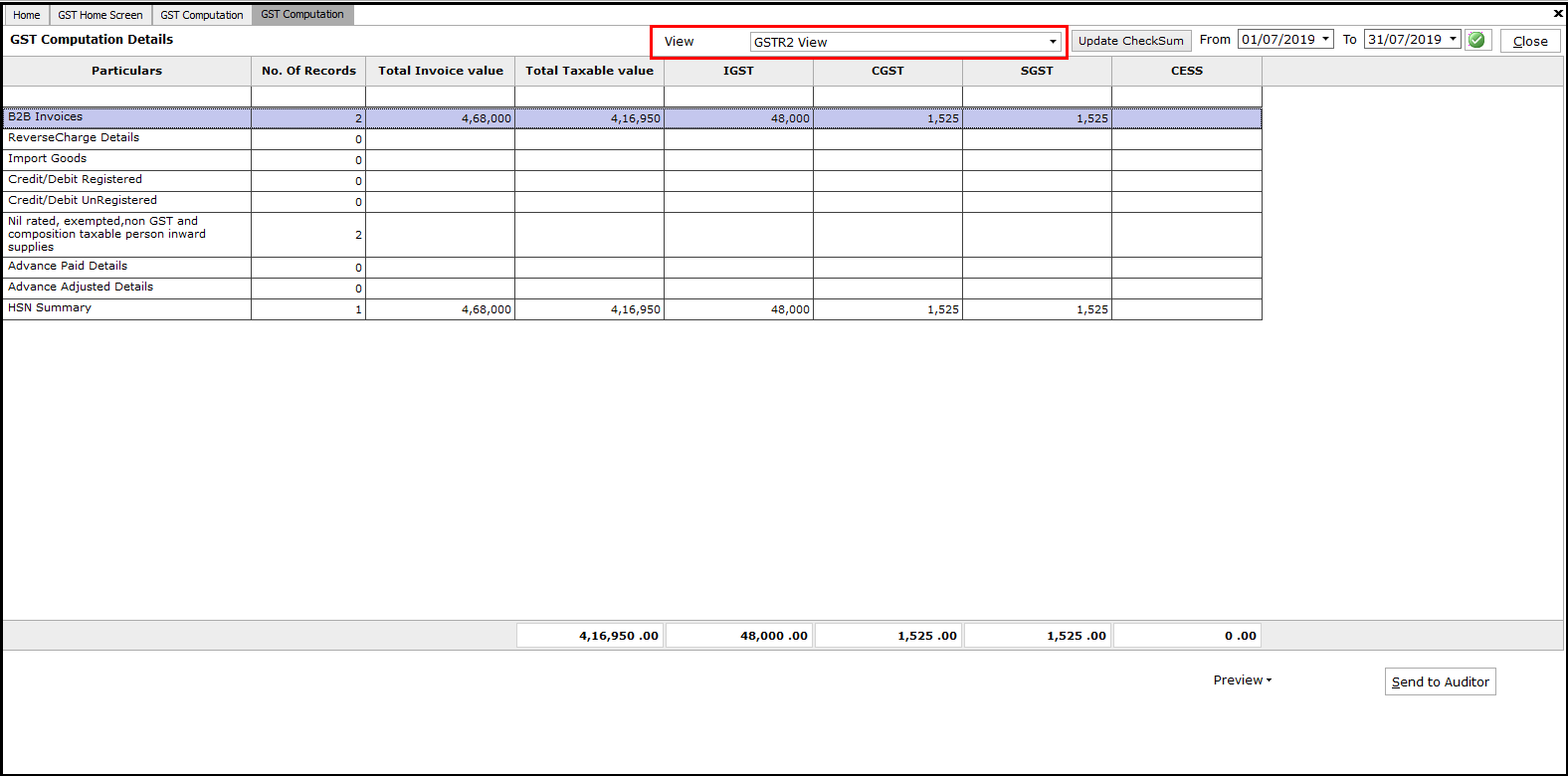

- GSTR2 View: Similar to GSTR1, GSTR2 details can also be seen by selecting this view option.

-

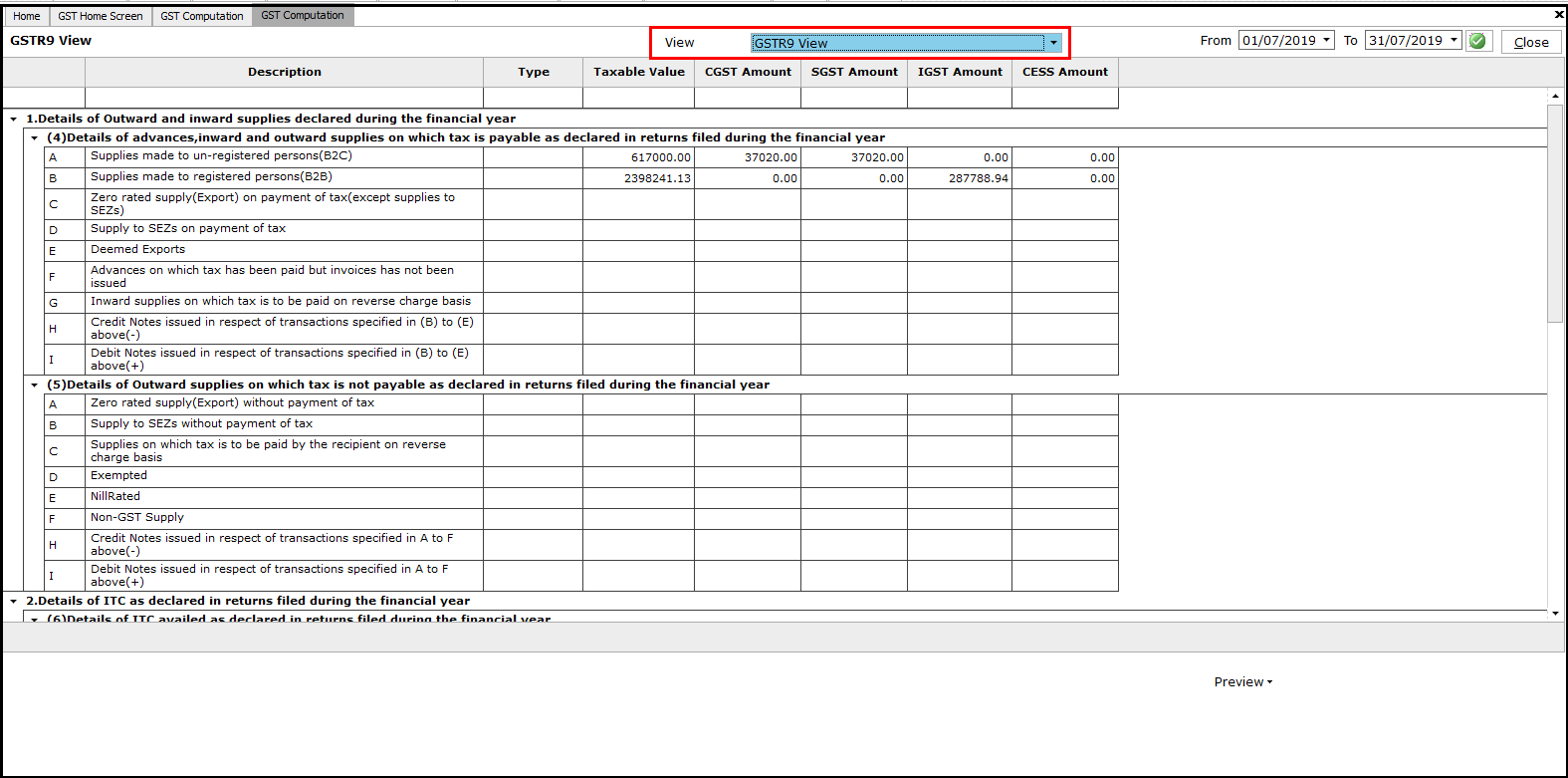

GSTR9 View: Lastly, this view will provide the details required for the annual return filing of GSTR 9.

In all the above-mentioned view screens, one can export the details into an Excel, HTML or Text report by right click on the screen as well as on click on the Preview button on the screen.

In all the above-mentioned view screens, one can export the details into an Excel, HTML or Text report by right click on the screen as well as on click on the Preview button on the screen.

The report can also be emailed as an attachment in a defined format, provided Email Settings are done.

Auto porting of GST payable to Journal Voucher

Under a Detailed view, if you want to view the details of Carry Forward/ Payable tax details, then enable the option Carry Forward/Payable. This displays the Tax that is carry forwarded from the previous month.

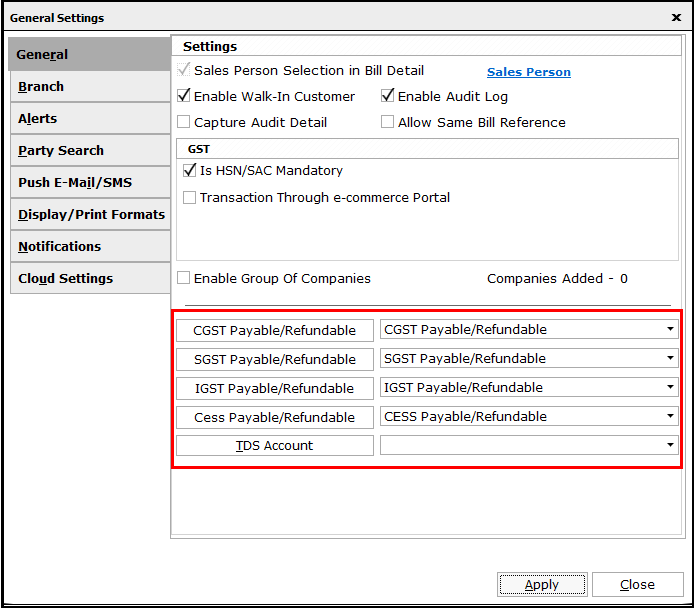

To pass a Journal voucher for payment of GST, first, make the basic settings of tax ledger mapping under General Settings in Master.

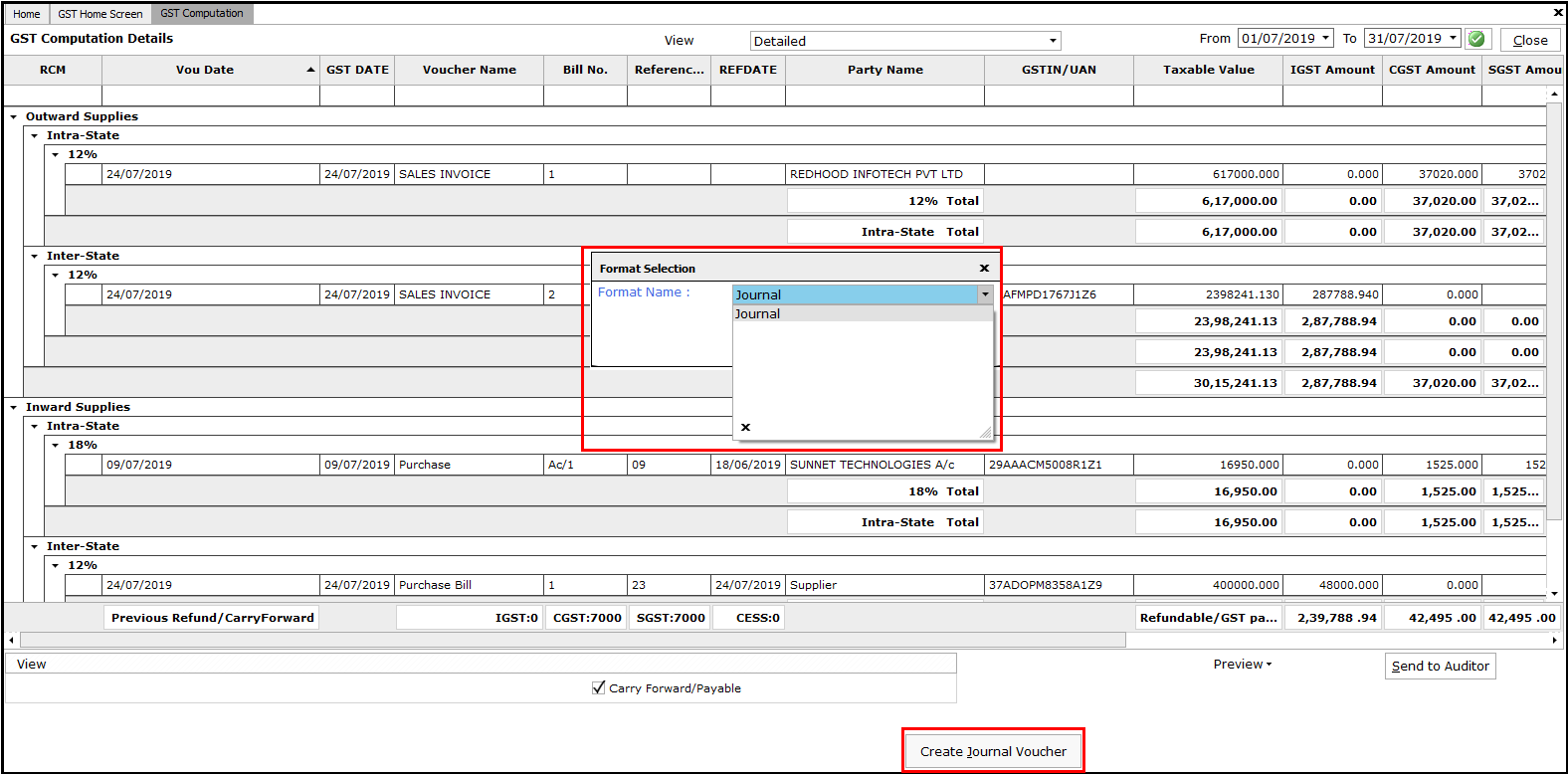

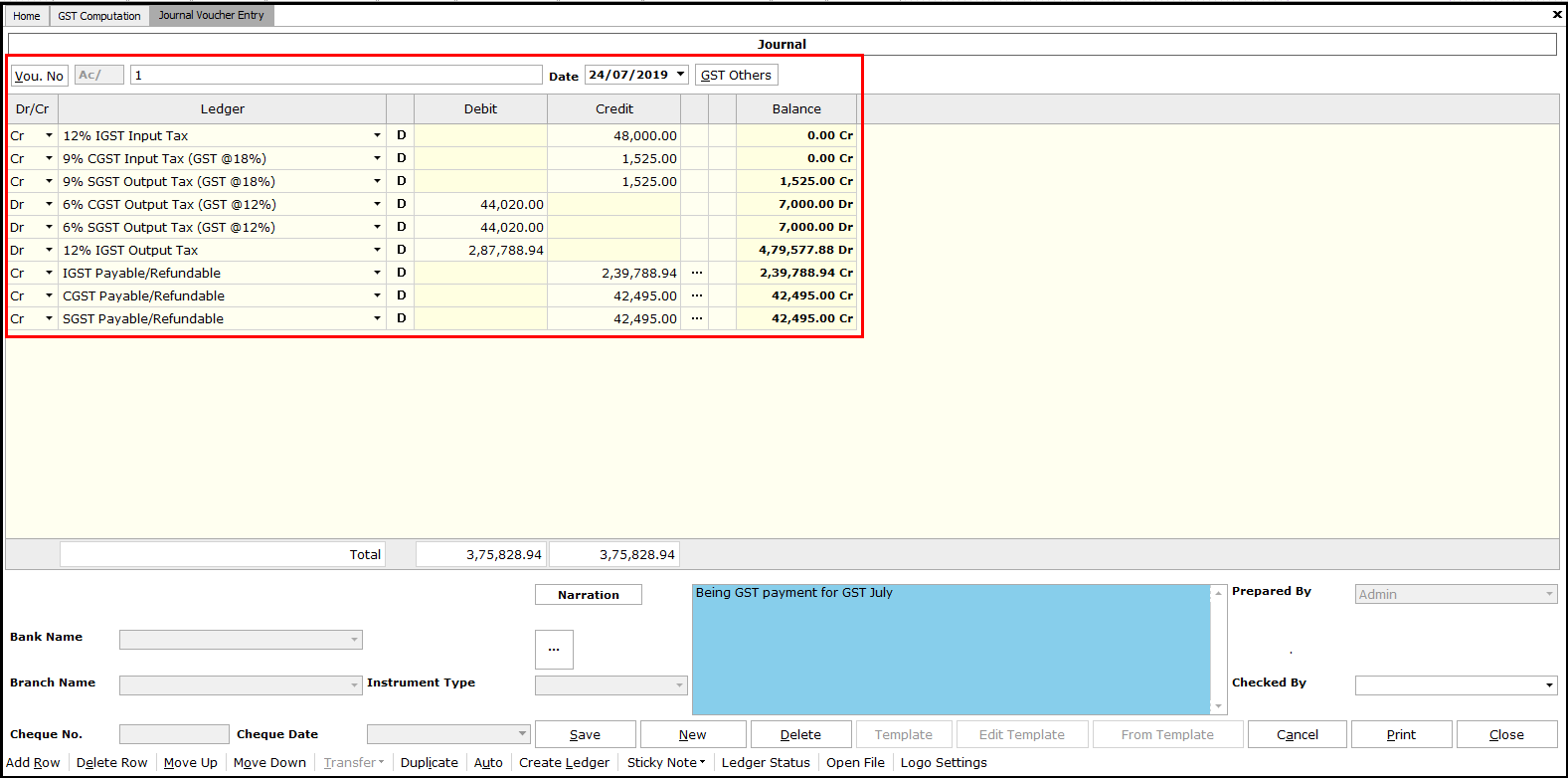

After completing the process, click on Create Journal Voucher in GST Computation view, Detailed View mode. Select the format to view the details have to be ported and click on OK.

The journal Voucher will be created and the serial number of the voucher will be displayed.

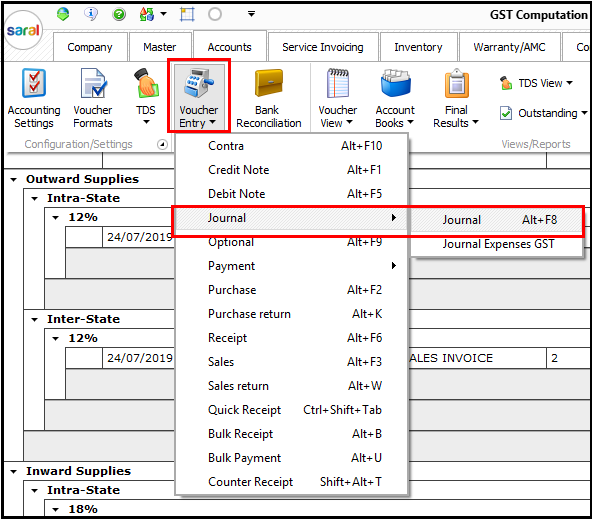

To view the voucher created, go to Journal under Voucher Entry in Accounts Module.

Here, select the voucher as displayed earlier from Vou. No. button. The voucher created will be displayed.

This is the process of viewing GST Computation in Saral with auto porting of GST payable amount to Journal Voucher.